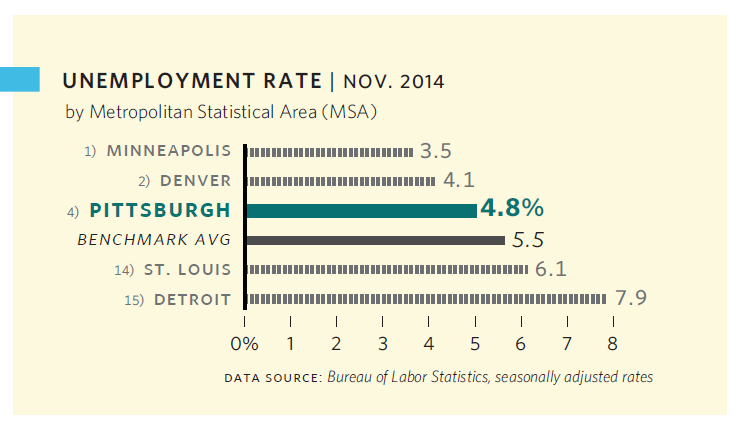

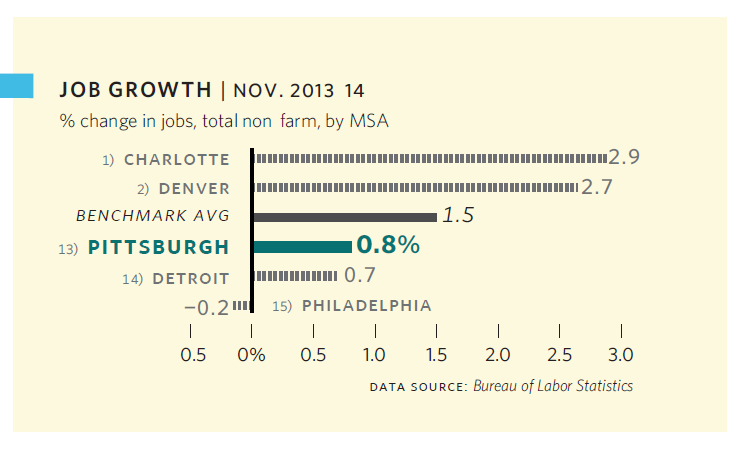

Southwestern Pennsylvania is in solid economic shape entering 2015. Employment is holding near all-time highs, and the seven-county unemployment rate has fallen to just under 5 percent — with the historic low of 4.1 percent in sight for 2016. But stalled labor force growth since late 2012 should temper excitement regarding the unemployment rate’s descent, as a lack of new labor-force entrants will inevitably slow regional business expansion. Regional employment will manage gains of 10,000-15,000 this year, slower than the national pace but still allowing existing consumer spending trends to support economic health and moderate expansion.

The mix of recent regional industrial growth lends credence to an optimistic 2015 outlook. The broad professional and business services industry, our largest in employment, has provided a steady flow of new jobs since the recovery began in 2010. The education and health services industry ended 2014 as the strongest of our industrial pillars at 1 percent job growth over 2013 demonstrating that the economy’s key drivers are on firm ground. Even consumer spending dependent businesses finally showed signs of life, with hiring topping 2 percent in 2014, and catching up with the national pace for the first time during this recovery. Natural resources development (Marcellus Shale drilling and related activities) remains a small, but fast-growing industry here, though it looks to slow in 2015-16 with the recent plunge in natural gas prices. But this industry is only in its infancy here, with positive longer-term projections outweighing concerns about near-term weakness.

On the downside, our manufacturing, transportation and utilities industries have shed jobs for two years. The declines have been marginal, but losses in these relatively high-paying industries apply the brakes to income growth, and therefore to consumption-driven business expansion. Yet, 2015 brings some upside potential. The Federal Reserve is likely to raise interest rates from their near-zero level by mid-year. While higher rates would normally discourage business expansion through more costly borrowing, businesses across the U.S. are simultaneously inching toward a capacity utilization rate that historically triggers the need for expansion. So businesses could find the reality of soon-to-rise interest rates incentive enough to act now, taking advantage of still-low borrowing costs and putting saved corporate profits of the past five years to productive use. Faster national economic growth in 2015 would be good news regionally, where manufacturing industries are tied to business expansion prospects. Pittsburgh’s manufacturing is most concentrated in metals, machinery, and computers and electronics, which all need business expansion to make meaningful progress.

By the end of 2014, Greater Pittsburgh’s housing market had cooled appreciably, setting the stage for a more traditional slow growth rate in 2015. Average existing regional home prices are nearly 11 percent above their pre-recession peak in 2006, compared with Pennsylvania and U.S. averages of 6 and 19 percent, respectively, below pre-recession peaks. So, while our 2015 house price gains won’t be eye-catching, we’ll still see the “wealth effect” benefits of a healthy housing market, leading to consumer confidence and spending potential.

Pittsburgh’s new residential permitting activity slowed in the second half of 2014 and finished marginally below the prior year’s pace. But, again, the pace of construction permitting here for new single-family homes is closer to equilibrium than it is in Pennsylvania or the nation. In housing markets, as with job creation, our region’s 2015 outlook is one of continued steady gains, as opposed to attention-grabbing recovery or acceleration.

Nonresidential construction is likely to remain strong with the completion of several major projects and groundbreaking for new ones.

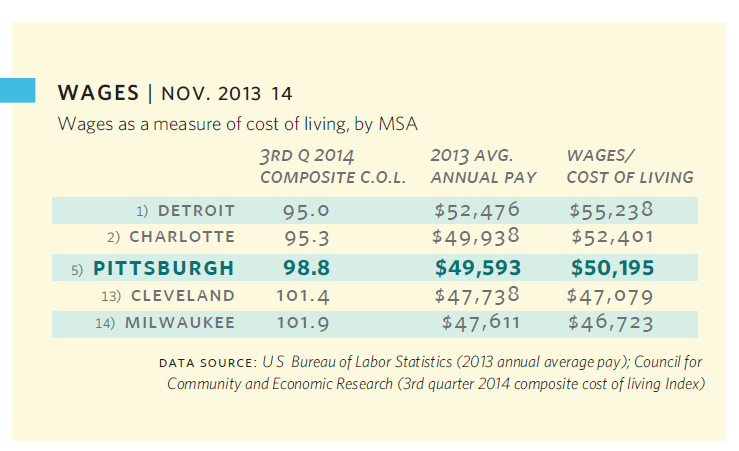

Southwestern Pennsylvania’s long-time trend of population decline is in the early stages of a turnaround. With new industrial development, housing market stability, and broad urban development ongoing, we should retain and attract young workers and families for years to come. Reliable education, healthcare and financial industry employers are firmly entrenched and will support workforce development for the foreseeable future. Pittsburgh is well positioned to benefit from Marcellus gas drilling activity over the longer term. Skilled workers in this industry will find our low living costs attractive, and, as a result, migration trends are likely to see a boost over the coming decade.